28 August 2018

Bob Cunneen, Senior Economist and Portfolio Specialist

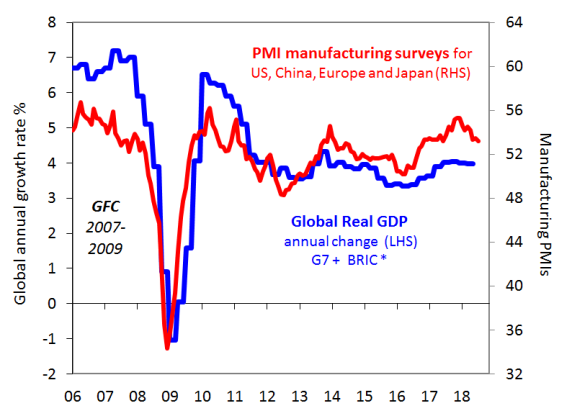

Global activity vs Manufacturing surveys

* The countries collectively known as the Group of Seven (G7) consists of the US, Canada, the UK, France, Germany, Italy and Japan. BRIC refers to Brazil, Russia, India and China

Source: Markit.

The global economy entered 2018 with strong growth prospects. Low global interest rates and US tax cuts suggested that the global economy could accelerate from the 4% annual growth pace in late 2017 (blue line). However this year has seen the promise of stronger global growth confront a tougher reality. Concerns about President Trump’s ‘trade wars’, the Federal Reserve (Fed) raising US interest rates and emerging market problems are now casting a shadow over global growth.

A key leading indicator for global growth are the Purchasing Managers’ Indexes (PMI). Notably the manufacturing PMIs for US, China, Europe and Japan have all moderated over recent months (red line). Manufacturers appear to be concerned that this trade war between the US, Europe and Asia will penalise export opportunities. The Fed’s strategy to raise US interest rates is also tightening financial conditions. A particular concern for emerging markets such as Argentina and Turkey is that higher US interest rates and the rising US dollar are increasing their foreign debt burdens. These emerging market problems are now feeding back into the major economies by curtailing demand for their manufactured goods.

So the global economy enters the final stages of 2018 with fading prospects. The early resolution to this trade war and stabilisation in emerging markets are necessary to ensure that the global growth profile stays positive for next year.

Source: Nab assetmanagement August 2018

Important Information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.