25 June 2018

Bob Cunneen, Senior Economist and Portfolio Specialist

Australian home prices

Sources: Australian Bureau of Statistics (ABS) 6416.0 – Residential Property Price Indexes: Eight Capital Cities, March 2018.

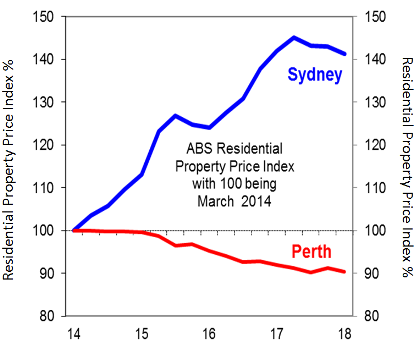

Australia’s housing boom over the past four years has seen contrasting fortunes.

The Reserve Bank of Australia’s (RBA) Board meeting minutes for June 2018 noted that “housing prices were still 40 per cent higher in Sydney and Melbourne than at the beginning of 2014, while housing prices in Perth had fallen by around 10 per cent over the same period.”

Yet there are signs that Sydney’s status as the “Emerald City” is losing some sparkle.

According to the Australian Bureau of Statistics property data, house prices have slipped by 1% over the past year to March 2018. The RBA has noted that “housing markets in Sydney and Melbourne have slowed” as the “Australian Prudential Regulation Authority’s supervisory measures and tighter credit standards have been helpful in containing the build-up of risk in household balance sheets”.

For Perth, home prices have also fallen by 1% over the past year. However with the Mining sector now showing renewed confidence and new iron ore investment projects, Perth may be set to shine as the new Emerald City across the Nullarbor.

Source : Nab assetmanagement June 2018

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.